Fundamental Analysis of Cryptocurrency Projects

- Understanding the Basics of Fundamental Analysis in Cryptocurrency

- Key Factors to Consider When Evaluating Cryptocurrency Projects

- Analyzing the Team and Technology Behind Cryptocurrency Projects

- Assessing the Market Potential and Adoption of Cryptocurrencies

- The Importance of Whitepapers and Roadmaps in Fundamental Analysis

- Risk Management Strategies for Investing in Cryptocurrency Projects

Understanding the Basics of Fundamental Analysis in Cryptocurrency

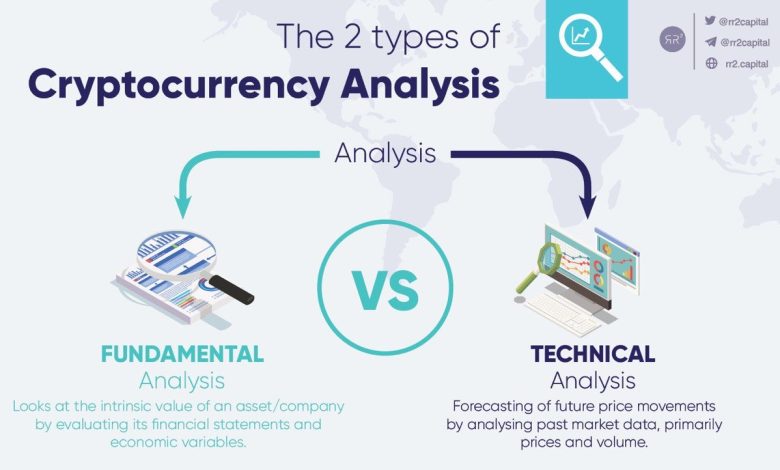

Fundamental analysis in cryptocurrency involves evaluating the underlying factors that can affect the value of a digital asset. This type of analysis focuses on the project’s team, technology, roadmap, market potential, and overall viability. By understanding these key aspects, investors can make more informed decisions about which cryptocurrencies to invest in.

One of the key factors to consider when conducting fundamental analysis is the project’s team. A strong and experienced team can greatly increase the chances of a project’s success. Investors should research the backgrounds of the team members, their previous projects, and their level of expertise in the cryptocurrency space.

Another important aspect of fundamental analysis is the technology behind the cryptocurrency project. Investors should assess the project’s whitepaper, codebase, and any partnerships with tech companies. Understanding the technology can help investors determine the project’s potential for long-term success.

Additionally, investors should evaluate the project’s roadmap to see if it aligns with their investment goals. A clear and achievable roadmap can indicate that the project has a solid plan for development and growth. Investors should also consider the market potential of the project and whether it addresses a real-world problem or need.

Overall, fundamental analysis is a crucial tool for investors looking to navigate the complex world of cryptocurrency. By carefully evaluating the key factors that can impact a project’s success, investors can make more informed decisions and potentially maximize their returns in the long run.

Key Factors to Consider When Evaluating Cryptocurrency Projects

When evaluating cryptocurrency projects, there are several key factors to consider that can help investors make informed decisions. These factors can provide valuable insights into the potential success and viability of a project. Some of the key factors to consider include:

– **Team**: The team behind a cryptocurrency project is crucial to its success. Look for a team with a strong track record in the industry and experience in relevant fields such as blockchain technology, finance, and marketing.

– **Technology**: The technology behind a cryptocurrency project is another important factor to consider. Evaluate the project’s whitepaper to understand the technology and its potential applications. Look for projects that offer innovative solutions to real-world problems.

– **Community**: The community surrounding a cryptocurrency project can also provide valuable insights. Look for projects with an active and engaged community of supporters. A strong community can help drive adoption and growth.

– **Partnerships**: Partnerships with other companies and organizations can also be a good indicator of a project’s potential success. Look for projects that have established partnerships with reputable companies in the industry.

– **Market Potential**: Consider the market potential for a cryptocurrency project. Evaluate the size of the market it is targeting and the potential for growth. Look for projects that address a real need in the market.

– **Regulatory Environment**: The regulatory environment can also impact the success of a cryptocurrency project. Consider the regulatory challenges that the project may face and how it plans to address them.

By carefully evaluating these key factors, investors can make more informed decisions when it comes to investing in cryptocurrency projects. It is important to conduct thorough research and due diligence to assess the potential risks and rewards of a project before making any investment decisions.

Analyzing the Team and Technology Behind Cryptocurrency Projects

When analyzing the team and technology behind cryptocurrency projects, it is essential to consider the expertise and experience of the individuals involved. A strong team with a diverse skill set can greatly impact the success of a project. Look for developers with a proven track record in blockchain technology, as well as advisors with experience in finance and business development.

In addition to the team, it is crucial to evaluate the technology that underpins the cryptocurrency project. Consider factors such as the scalability, security, and decentralization of the blockchain network. Look for projects that are built on robust and innovative technology, as this can indicate long-term viability and potential for growth.

Furthermore, assess how the project plans to implement new technologies such as smart contracts, privacy features, or interoperability with other blockchains. These advancements can set a project apart from its competitors and attract a wider user base.

Overall, a thorough analysis of the team and technology behind a cryptocurrency project can provide valuable insights into its potential for success. By considering these factors carefully, investors can make more informed decisions and mitigate risks in the volatile cryptocurrency market.

Assessing the Market Potential and Adoption of Cryptocurrencies

When assessing the market potential and adoption of cryptocurrencies, it is essential to consider various factors that can influence their success. One key aspect to analyze is the overall market demand for digital assets. Understanding the current trends and preferences of investors can provide valuable insights into the future growth of cryptocurrencies.

Additionally, evaluating the regulatory environment is crucial in determining the level of acceptance and integration of cryptocurrencies into the mainstream financial system. Government policies and regulations can either facilitate or hinder the adoption of digital currencies, impacting their market potential significantly.

Furthermore, examining the technological advancements and innovations within the cryptocurrency space is essential. The development of new blockchain technologies and protocols can enhance the scalability, security, and efficiency of digital assets, making them more attractive to users and investors alike.

Moreover, analyzing the competition within the cryptocurrency market is vital in understanding the challenges and opportunities that exist for different projects. Identifying the strengths and weaknesses of competing cryptocurrencies can help investors make informed decisions about where to allocate their resources.

In conclusion, a comprehensive assessment of the market potential and adoption of cryptocurrencies requires a thorough analysis of market demand, regulatory environment, technological advancements, and competition. By considering these factors carefully, investors can gain valuable insights into the future prospects of digital assets and make informed investment decisions.

The Importance of Whitepapers and Roadmaps in Fundamental Analysis

Whitepapers and roadmaps play a crucial role in the fundamental analysis of cryptocurrency projects. These documents provide valuable insights into the project’s goals, technology, and roadmap for development. By carefully analyzing whitepapers and roadmaps, investors can gain a better understanding of the project’s potential for success.

Whitepapers typically outline the project’s vision, technical details, and use cases for the cryptocurrency. They provide a detailed explanation of how the technology works and how it solves a particular problem. Roadmaps, on the other hand, lay out the project’s timeline for development, including key milestones and goals.

When conducting fundamental analysis, investors should pay close attention to the information presented in whitepapers and roadmaps. They can help assess the viability of the project, the team’s capabilities, and the potential for future growth. Additionally, whitepapers and roadmaps can help investors identify any red flags or warning signs that may indicate a project is not worth investing in.

Overall, whitepapers and roadmaps are essential tools for investors looking to make informed decisions about cryptocurrency projects. By carefully reviewing these documents and conducting thorough research, investors can mitigate risks and increase their chances of success in the volatile cryptocurrency market.

Risk Management Strategies for Investing in Cryptocurrency Projects

Investing in cryptocurrency projects can be a lucrative opportunity, but it also comes with its fair share of risks. To mitigate these risks, it is essential to implement **risk management strategies** that can help protect your investment. Here are some key strategies to consider:

- **Diversification**: One of the most effective ways to manage risk in cryptocurrency investing is to diversify your portfolio. By spreading your investment across different projects, you can reduce the impact of any single project failing.

- **Due Diligence**: Before investing in any cryptocurrency project, it is crucial to conduct thorough research and due diligence. This includes analyzing the project’s whitepaper, team members, technology, and market potential.

- **Risk Assessment**: Assessing the risk associated with each cryptocurrency project is essential. Consider factors such as market volatility, regulatory risks, and technological vulnerabilities before making an investment decision.

- **Stop-loss Orders**: Implementing stop-loss orders can help limit your losses in case the market takes a downturn. This automated trading strategy can help you exit a position when the price reaches a certain level.

- **Stay Informed**: The cryptocurrency market is constantly evolving, so it is essential to stay informed about the latest developments. Keep up with news, trends, and market analysis to make informed investment decisions.

By incorporating these risk management strategies into your cryptocurrency investing approach, you can help protect your investment capital and increase your chances of success in this volatile market. Remember that while the potential for high returns exists, so does the risk of significant losses. By being proactive and diligent in your risk management efforts, you can navigate the cryptocurrency market with more confidence and security.