How to Safely Store Your Cryptocurrencies

- Understanding the Risks of Storing Cryptocurrencies

- Choosing the Right Wallet for Your Cryptocurrencies

- Implementing Two-Factor Authentication for Added Security

- Backing Up Your Wallet: Best Practices to Avoid Losing Your Cryptocurrencies

- Protecting Your Private Keys: The Key to Secure Cryptocurrency Storage

- Offline Storage Solutions: Keeping Your Cryptocurrencies Safe from Online Threats

Understanding the Risks of Storing Cryptocurrencies

It is crucial to understand the risks associated with storing cryptocurrencies to ensure the safety of your digital assets. Cryptocurrencies are vulnerable to hacking, theft, and fraud due to their decentralized and digital nature. By being aware of these risks, you can take necessary precautions to protect your investments.

One of the main risks of storing cryptocurrencies is the potential for hacking. Hackers can exploit vulnerabilities in online wallets, exchanges, or even individual devices to gain access to your funds. It is essential to use secure wallets and platforms with robust security measures to minimize this risk.

Another risk to consider is the possibility of losing access to your cryptocurrencies. This can happen if you forget your private keys or passwords, or if your wallet becomes corrupted. It is crucial to keep backups of your keys and use secure password management practices to prevent this from happening.

Additionally, there is a risk of fraud in the cryptocurrency space. Scammers may try to trick you into sending them your funds or sharing sensitive information. Be cautious of unsolicited messages or offers, and always verify the legitimacy of the sender before taking any action.

Overall, understanding the risks of storing cryptocurrencies is essential for safeguarding your investments. By staying informed and implementing best security practices, you can protect your digital assets from potential threats and ensure peace of mind when it comes to managing your cryptocurrency portfolio.

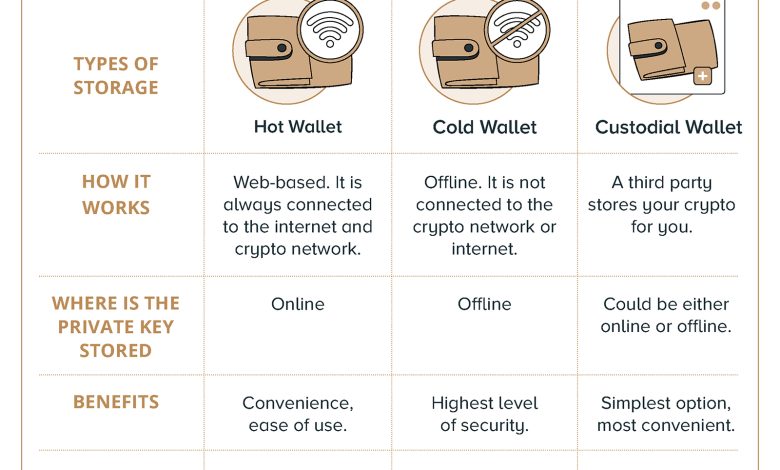

Choosing the Right Wallet for Your Cryptocurrencies

When it comes to storing your cryptocurrencies, choosing the right wallet is crucial. There are several types of wallets available, each with its own set of features and security measures. It’s important to consider factors such as convenience, security, and ease of use when selecting a wallet for your digital assets.

One option is a hardware wallet, which is a physical device that stores your cryptocurrencies offline. This type of wallet is considered one of the most secure options available, as it is not connected to the internet, making it less vulnerable to hacking. Hardware wallets are also convenient to use, as they allow you to easily access your funds when needed.

Another option is a software wallet, which is a digital wallet that can be accessed through an app or website. Software wallets are convenient for everyday use, as they allow you to easily send and receive cryptocurrencies. However, they are more vulnerable to hacking than hardware wallets, as they are connected to the internet.

A third option is a paper wallet, which is a physical document that contains your public and private keys. Paper wallets are considered one of the most secure options, as they are not connected to the internet at all. However, they can be easily lost or damaged, so it’s important to store them in a safe place.

Ultimately, the right wallet for you will depend on your individual needs and preferences. It’s important to research different types of wallets and choose one that offers the level of security and convenience that you require. By taking the time to select the right wallet for your cryptocurrencies, you can help ensure that your digital assets are safe and secure.

Implementing Two-Factor Authentication for Added Security

One effective way to enhance the security of your cryptocurrency storage is by implementing two-factor authentication (2FA). This additional layer of security requires users to provide two different authentication factors before gaining access to their accounts, making it more difficult for unauthorized individuals to breach your account.

When setting up 2FA for your cryptocurrency wallet or exchange account, you typically have the option to choose from different authentication methods, such as SMS codes, email verification, or authenticator apps like Google Authenticator or Authy. It is recommended to use an authenticator app for 2FA as it is considered more secure than SMS or email verification.

By enabling 2FA, you add an extra step to the login process, requiring not only your password but also a unique code generated by the authenticator app. This means that even if someone manages to obtain your password, they would still need access to your mobile device to log in successfully.

Overall, implementing two-factor authentication is a simple yet effective way to bolster the security of your cryptocurrency holdings. It adds an additional layer of protection against unauthorized access and reduces the risk of potential security breaches. Take the time to set up 2FA for your accounts to safeguard your investments and ensure peace of mind.

Backing Up Your Wallet: Best Practices to Avoid Losing Your Cryptocurrencies

When it comes to storing your cryptocurrencies, backing up your wallet is crucial to avoiding the risk of losing your assets. Here are some best practices to help you secure your investment:

- Use a hardware wallet: Hardware wallets are considered one of the safest options for storing cryptocurrencies. They are offline devices that store your private keys securely.

- Backup your wallet: Make sure to backup your wallet regularly. This can be done by exporting your private keys or seed phrase and storing them in a secure location.

- Encrypt your wallet: Encrypting your wallet adds an extra layer of security to protect your assets from unauthorized access.

- Use multi-signature wallets: Multi-signature wallets require multiple signatures to authorize a transaction, making it harder for hackers to steal your cryptocurrencies.

- Keep your software up to date: Regularly updating your wallet software can help protect it from security vulnerabilities and malware attacks.

By following these best practices, you can ensure that your cryptocurrencies are securely stored and protected from potential loss or theft.

Protecting Your Private Keys: The Key to Secure Cryptocurrency Storage

Protecting your private keys is crucial when it comes to securely storing your cryptocurrencies. Private keys are essentially the passwords that give you access to your digital assets. If someone gains access to your private keys, they can easily steal your funds without your knowledge. Therefore, it is essential to take the necessary precautions to keep your private keys safe and secure.

One of the best ways to protect your private keys is by using a hardware wallet. Hardware wallets are physical devices that store your private keys offline, making them less vulnerable to hacking attempts. By keeping your private keys offline, you can significantly reduce the risk of unauthorized access to your funds.

Another important aspect of protecting your private keys is to never share them with anyone. Your private keys should be kept confidential at all times. Avoid storing your private keys on your computer or any online platform, as these can be easily compromised by hackers. It is recommended to write down your private keys on a piece of paper and store it in a secure location.

Offline Storage Solutions: Keeping Your Cryptocurrencies Safe from Online Threats

When it comes to keeping your cryptocurrencies safe from online threats, offline storage solutions are a highly recommended option. By storing your digital assets offline, you can significantly reduce the risk of falling victim to cyber attacks and hacking attempts.

One popular offline storage solution is a hardware wallet, which is a physical device that stores your private keys offline. This type of wallet is considered one of the most secure options available, as it is not connected to the internet and therefore not susceptible to online threats.

Another offline storage solution is a paper wallet, which involves printing out your private keys and storing them in a secure location. While this method is more vulnerable to physical threats such as theft or damage, it is still considered a safer option than keeping your private keys online.

Overall, offline storage solutions provide an extra layer of security for your cryptocurrencies and are highly recommended for anyone looking to keep their digital assets safe from online threats.