The Impact of Major News Events on the Crypto Market

- The Ripple Effect: How Major News Events Influence Crypto Market Trends

- Breaking News: Analyzing the Immediate Impact on Cryptocurrency Prices

- Market Volatility: How Global Events Shake Up the Crypto Market

- The Power of Perception: How Media Coverage Shapes Crypto Market Sentiment

- Regulatory Ripples: How Government Actions Impact the Crypto Market

- From Bullish to Bearish: Understanding the Market Reaction to Major News Events

The Ripple Effect: How Major News Events Influence Crypto Market Trends

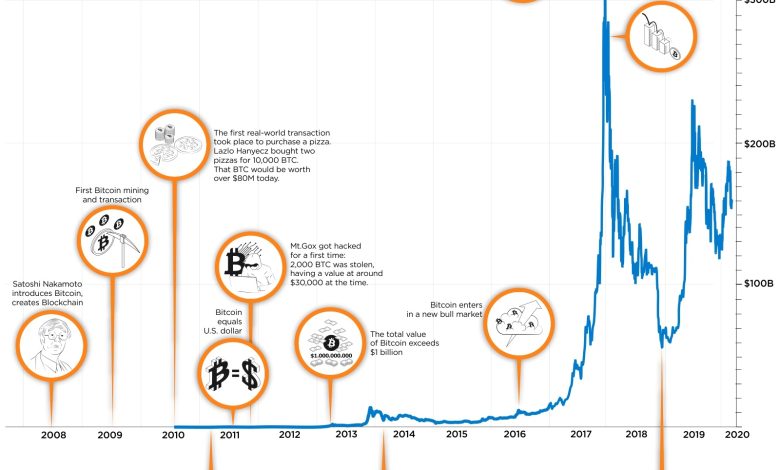

Major news events have a significant impact on the trends in the cryptocurrency market. These events can create a ripple effect that influences the prices of various digital assets. When there is positive news, such as regulatory approval or adoption by a major company, it can lead to a surge in prices as investors become more optimistic about the future of the market. Conversely, negative news like security breaches or regulatory crackdowns can cause prices to plummet as investors panic and sell off their holdings.

It is essential for cryptocurrency traders and investors to stay informed about major news events that could potentially affect the market. By keeping a close eye on news sources and staying up to date with the latest developments, individuals can make more informed decisions about when to buy or sell their assets. Understanding how news events can impact market trends is crucial for navigating the volatile world of cryptocurrency trading.

Overall, the ripple effect of major news events on the cryptocurrency market is undeniable. Whether it’s a positive or negative event, the repercussions can be felt across the entire market. Being aware of these influences and how they can shape market trends is key to successfully navigating the ever-changing landscape of cryptocurrency trading.

Breaking News: Analyzing the Immediate Impact on Cryptocurrency Prices

When major news events occur, the cryptocurrency market is often subject to immediate fluctuations in prices. This is due to the fact that investors and traders react quickly to new information, causing rapid changes in the value of digital assets. Analyzing the immediate impact of breaking news on cryptocurrency prices can provide valuable insights into market dynamics and help traders make informed decisions.

For example, when news of a regulatory crackdown on a specific cryptocurrency is announced, prices of that asset may plummet as investors panic and sell off their holdings. Conversely, positive news such as a major partnership or adoption by a well-known company can lead to a surge in prices as investors rush to buy in anticipation of future gains.

It is essential for traders to stay informed about current events and news developments that could affect the cryptocurrency market. By closely monitoring breaking news and analyzing its immediate impact on prices, traders can better understand market trends and position themselves to capitalize on opportunities for profit.

Market Volatility: How Global Events Shake Up the Crypto Market

Market volatility is a common occurrence in the crypto market, with prices often experiencing significant fluctuations in response to global events. These events can range from geopolitical tensions to economic indicators, all of which have the potential to shake up the market and cause prices to rise or fall rapidly.

One of the key factors that contribute to market volatility is the uncertainty that comes with major news events. Investors may react impulsively to news, leading to sudden shifts in market sentiment and prices. This can create opportunities for traders to profit from these price movements, but it also poses risks for those who are not prepared for the volatility.

Global events such as regulatory announcements, economic data releases, and geopolitical tensions can all have a significant impact on the crypto market. For example, news of a government crackdown on cryptocurrencies in a major market can lead to a sharp decline in prices, while positive news such as the adoption of blockchain technology by a large corporation can cause prices to surge.

It is important for investors to stay informed about global events and their potential impact on the crypto market. By keeping a close eye on the news and understanding how different events can affect prices, investors can make more informed decisions about when to buy or sell their assets. This can help them navigate the market volatility and potentially profit from it.

The Power of Perception: How Media Coverage Shapes Crypto Market Sentiment

The power of perception plays a crucial role in shaping the sentiment of the crypto market. Media coverage has a significant impact on how investors perceive the market and can influence their decision-making process. Positive news stories can create a sense of optimism and drive up prices, while negative news can lead to fear and uncertainty, causing prices to drop.

It is essential for investors to be aware of how media coverage can shape their perception of the market. By staying informed and critically evaluating news stories, investors can make more informed decisions and avoid being swayed by sensationalist headlines. Understanding the role of media in shaping market sentiment is key to navigating the volatile world of cryptocurrency.

Regulatory Ripples: How Government Actions Impact the Crypto Market

Government actions have a significant impact on the cryptocurrency market, causing regulatory ripples that can lead to volatility and uncertainty among investors. When news of new regulations or crackdowns on crypto exchanges and projects surface, it often triggers a selloff as traders react to the potential implications.

For example, when China announced a ban on cryptocurrency mining operations, the market experienced a sharp dip as miners were forced to shut down their operations. This not only affected the price of Bitcoin but also had a ripple effect on other altcoins as well.

Similarly, when the US Securities and Exchange Commission (SEC) announced investigations into initial coin offerings (ICOs) for potential fraud and securities violations, it sent shockwaves through the market. Projects under scrutiny saw their token prices plummet, and investors became wary of participating in new token sales.

These government interventions highlight the regulatory challenges facing the crypto industry and underscore the need for clear guidelines to ensure market stability. As regulators around the world continue to monitor and regulate cryptocurrencies, investors must stay informed and adapt to the changing regulatory landscape to navigate the crypto market successfully.

From Bullish to Bearish: Understanding the Market Reaction to Major News Events

When major news events occur in the crypto market, there is often a significant shift in investor sentiment from **bullish** to **bearish** or vice versa. Understanding how the market reacts to these events is crucial for investors looking to make informed decisions.

One common reaction to major news events is a **sell-off** as investors panic and rush to liquidate their holdings. This can lead to a sharp decline in prices as supply outweighs demand. On the other hand, positive news events can trigger a **buying frenzy**, causing prices to surge as investors rush to capitalize on the opportunity.

It is essential for investors to stay informed about major news events and understand how they can impact the market. By keeping a close eye on news sources and market trends, investors can better anticipate market reactions and make strategic decisions to **capitalize** on opportunities or mitigate risks.