The Impact of Mining on Cryptocurrency Prices

- Understanding the relationship between mining and cryptocurrency prices

- The role of mining in determining the value of cryptocurrencies

- How mining activities influence the volatility of digital assets

- Exploring the connection between mining difficulty and price fluctuations

- The environmental and economic implications of cryptocurrency mining

- Strategies for investors to navigate the impact of mining on crypto prices

Understanding the relationship between mining and cryptocurrency prices

Mining plays a crucial role in the cryptocurrency ecosystem, as it is the process by which new coins are created and transactions are verified on the blockchain. The relationship between mining and cryptocurrency prices is complex and multifaceted, with several factors influencing the value of digital assets.

One key factor that affects cryptocurrency prices is the cost of mining. When the cost of mining a particular cryptocurrency is high, miners may be less inclined to continue mining that coin, leading to a decrease in supply. Conversely, when mining costs are low, more miners may join the network, increasing the supply of the coin and potentially driving down its price.

Another important aspect to consider is the mining difficulty, which is a measure of how hard it is to mine a new block on the blockchain. As mining difficulty increases, miners need more computational power to solve complex mathematical problems, which can drive up the cost of mining. This, in turn, can impact the price of the cryptocurrency, as miners may need to sell more coins to cover their expenses.

Additionally, the reward halving mechanism built into many cryptocurrencies can also influence prices. When the block reward is halved, miners receive fewer coins for their efforts, which can make mining less profitable. This can lead to a decrease in the supply of the cryptocurrency, potentially driving up its price.

Overall, the relationship between mining and cryptocurrency prices is intricate and dynamic, with various factors at play. By understanding how mining impacts prices, investors and enthusiasts can make more informed decisions about their involvement in the cryptocurrency market.

The role of mining in determining the value of cryptocurrencies

Mining plays a crucial role in determining the value of cryptocurrencies. The process of mining involves solving complex mathematical problems to validate transactions on the blockchain network. Miners are rewarded with newly minted coins for their efforts, which helps in regulating the supply of the cryptocurrency in circulation.

As more miners participate in the network, the difficulty of mining increases, leading to a slower rate of coin creation. This scarcity can drive up the value of the cryptocurrency as demand outstrips supply. Conversely, a decrease in mining activity can result in an oversupply of coins, causing the value to drop.

Furthermore, mining also impacts the security and decentralization of a cryptocurrency. A higher number of miners means a more secure network, as it becomes increasingly difficult for any single entity to control the majority of the mining power. This decentralization is a key factor in the trustworthiness and stability of a cryptocurrency.

How mining activities influence the volatility of digital assets

One of the key factors that influence the volatility of digital assets is mining activities. Mining plays a crucial role in the creation and maintenance of cryptocurrencies, such as Bitcoin and Ethereum. The process of mining involves solving complex mathematical problems to validate transactions and add them to the blockchain. This process requires a significant amount of computational power and energy, which can impact the supply and demand dynamics of digital assets.

When mining activities increase, more coins are generated, leading to an increase in the supply of the cryptocurrency. This can put downward pressure on prices as the market becomes flooded with new coins. Conversely, when mining activities decrease, the supply of the cryptocurrency decreases, which can drive up prices due to scarcity. This relationship between mining activities and supply levels can contribute to the volatility of digital assets.

Additionally, mining activities can also impact the sentiment of investors and traders in the cryptocurrency market. High levels of mining activity can signal confidence in the future value of a particular cryptocurrency, leading to increased investment and trading volume. On the other hand, a decrease in mining activity may raise concerns about the security and stability of a cryptocurrency, causing investors to sell off their holdings and leading to price declines.

Exploring the connection between mining difficulty and price fluctuations

One of the key factors influencing the price of cryptocurrencies is the mining difficulty. Mining difficulty refers to the complexity of solving mathematical problems in order to validate transactions and add new blocks to the blockchain. As mining difficulty increases, miners need more computational power and resources to mine new coins, which can impact the supply of the cryptocurrency.

There is a strong correlation between mining difficulty and price fluctuations in the cryptocurrency market. When mining difficulty rises, it becomes more challenging for miners to earn rewards, leading to a decrease in the supply of new coins. This scarcity can drive up the price of the cryptocurrency as demand outstrips supply.

Conversely, when mining difficulty decreases, it becomes easier for miners to validate transactions and mine new coins. This can lead to an increase in the supply of the cryptocurrency, putting downward pressure on the price. As a result, fluctuations in mining difficulty can have a significant impact on the price of a cryptocurrency.

It is important for investors and traders to monitor mining difficulty levels when analyzing the cryptocurrency market. By understanding the relationship between mining difficulty and price fluctuations, they can make more informed decisions about when to buy or sell cryptocurrencies. Additionally, keeping an eye on mining difficulty can provide valuable insights into the overall health and stability of a cryptocurrency network.

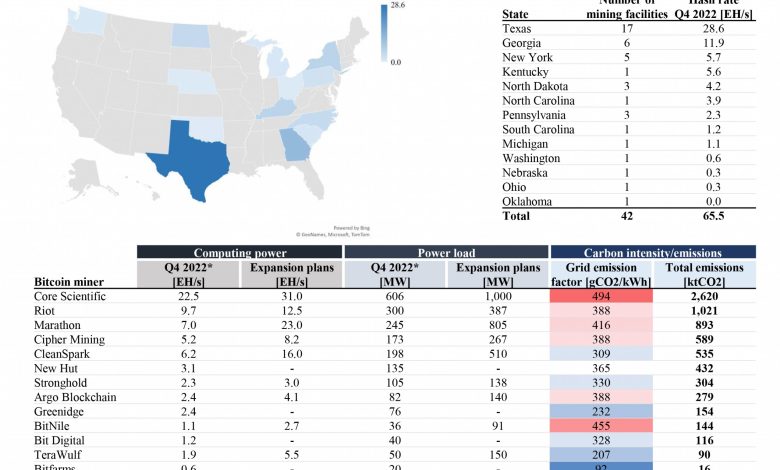

The environmental and economic implications of cryptocurrency mining

The environmental and economic implications of cryptocurrency mining are significant factors to consider when analyzing the impact of mining on cryptocurrency prices. Cryptocurrency mining requires a substantial amount of energy, leading to concerns about its environmental impact. The process of mining cryptocurrencies such as Bitcoin involves solving complex mathematical problems that require powerful computers to run continuously. This results in a high consumption of electricity, which can contribute to carbon emissions and environmental degradation.

Furthermore, the economic implications of cryptocurrency mining are also worth noting. The cost of electricity is a major expense for miners, and fluctuations in energy prices can directly impact their profitability. Additionally, the competition among miners to solve these mathematical problems and earn rewards can drive up the demand for energy, further exacerbating the environmental impact of mining.

As the popularity of cryptocurrencies continues to grow, so does the demand for mining activities. This has led to concerns about the sustainability of cryptocurrency mining in the long term. Some argue that the environmental and economic costs of mining outweigh the benefits, while others believe that technological advancements can help mitigate these issues. Ultimately, the environmental and economic implications of cryptocurrency mining play a crucial role in shaping the future of the industry and its impact on cryptocurrency prices.

Strategies for investors to navigate the impact of mining on crypto prices

Investors can employ various strategies to navigate the impact of mining on cryptocurrency prices. One approach is to diversify their investment portfolio across different cryptocurrencies. By spreading their investments, investors can mitigate the risk associated with fluctuations in the prices of individual cryptocurrencies due to mining activities.

Another strategy is to stay informed about the mining activities of different cryptocurrencies. By keeping track of the mining trends and developments in the industry, investors can make more informed decisions about when to buy or sell their holdings. Additionally, investors can consider investing in mining companies or funds that are involved in cryptocurrency mining. This can provide them with exposure to the mining industry without having to directly engage in mining activities themselves.

Furthermore, investors can also consider the environmental impact of mining on cryptocurrency prices. As concerns about the environmental sustainability of mining activities grow, investors may choose to support cryptocurrencies that use more energy-efficient mining algorithms. By aligning their investments with their values, investors can not only potentially benefit financially but also contribute to a more sustainable future for the cryptocurrency industry.

In conclusion, navigating the impact of mining on cryptocurrency prices requires careful consideration and strategic planning. By diversifying their portfolio, staying informed about mining activities, and considering the environmental implications of mining, investors can position themselves to make more informed decisions and potentially mitigate the risks associated with mining activities.