The Psychology of Cryptocurrency Investing

- Understanding the emotional rollercoaster of cryptocurrency investing

- The impact of fear and greed on investment decisions

- How cognitive biases can influence cryptocurrency trading

- The role of social proof in shaping investor behavior

- Managing stress and anxiety in the world of cryptocurrency

- The psychology behind FOMO and FUD in the crypto market

Understanding the emotional rollercoaster of cryptocurrency investing

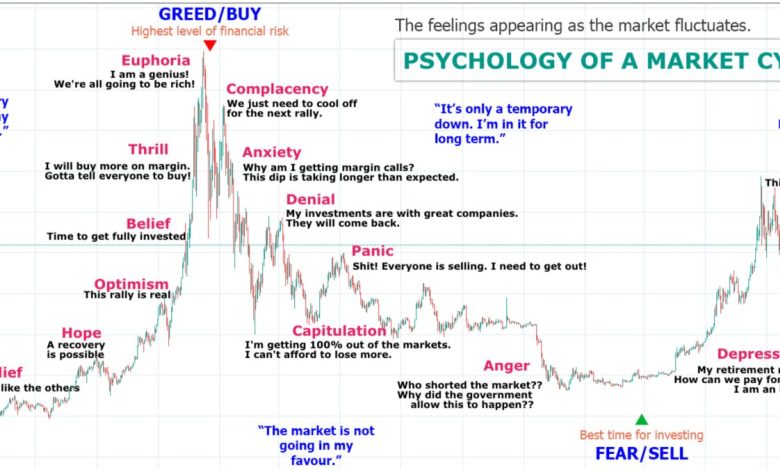

Investing in cryptocurrency can be a thrilling experience, but it also comes with its fair share of emotional ups and downs. The volatile nature of the market means that prices can fluctuate wildly in a short period of time, leading to feelings of excitement, anxiety, and even fear among investors. It is essential to understand the emotional rollercoaster that comes with cryptocurrency investing in order to make informed decisions and avoid making impulsive choices based on emotions rather than logic.

One of the key emotions that investors often experience when dealing with cryptocurrency is **uncertainty**. The market is highly unpredictable, and prices can change rapidly based on a variety of factors such as regulatory news, market sentiment, and technological developments. This uncertainty can lead to feelings of doubt and hesitation, causing investors to second-guess their decisions and potentially miss out on profitable opportunities.

Another common emotion that investors face is **greed**. When prices are rising rapidly, it can be tempting to chase after quick profits and invest more money than one can afford to lose. However, this can lead to reckless decision-making and ultimately result in significant financial losses. It is important to remain level-headed and stick to a well-thought-out investment strategy rather than giving in to the temptation of greed.

On the flip side, **fear** is another emotion that can plague cryptocurrency investors. When prices are falling, it is natural to feel anxious and worried about losing money. This fear can lead to panic selling, which often results in selling assets at a loss rather than holding onto them until prices recover. It is crucial to keep emotions in check during times of market downturns and remember that investing in cryptocurrency is a long-term game.

In conclusion, understanding the emotional rollercoaster of cryptocurrency investing is essential for success in the market. By recognizing and managing emotions such as uncertainty, greed, and fear, investors can make more rational decisions and avoid falling victim to common pitfalls. It is important to stay informed, stick to a solid investment plan, and not let emotions dictate investment choices.

The impact of fear and greed on investment decisions

When it comes to investment decisions in the world of cryptocurrency, fear and greed play a significant role. These two emotions can have a profound impact on how investors choose to allocate their funds and navigate the volatile market.

Fear can cause investors to make hasty decisions based on panic or uncertainty. When prices start to drop, fear can lead to a mass sell-off as investors rush to cut their losses. This can create a domino effect, causing prices to plummet even further. It’s essential for investors to manage their fear and not let it dictate their actions.

On the other hand, greed can lead investors to take on excessive risks in pursuit of high returns. This can result in investments that are not based on sound research or analysis, but rather on the desire for quick profits. Greed can blind investors to potential risks and cause them to overlook warning signs in the market.

Both fear and greed can cloud judgment and lead to irrational decision-making. It’s crucial for investors to be aware of these emotions and how they can influence their choices. By staying informed, conducting thorough research, and maintaining a disciplined approach, investors can mitigate the impact of fear and greed on their investment decisions in the cryptocurrency market.

How cognitive biases can influence cryptocurrency trading

When it comes to cryptocurrency trading, cognitive biases can play a significant role in influencing investors’ decisions. These biases are inherent mental shortcuts that can lead to irrational behavior and poor decision-making. Understanding how these biases can impact cryptocurrency trading is crucial for investors looking to navigate the volatile market successfully.

One common cognitive bias that can affect cryptocurrency trading is confirmation bias. This bias occurs when investors seek out information that confirms their existing beliefs about a particular cryptocurrency, while ignoring or dismissing any information that contradicts their views. This can lead to a skewed perception of the market and prevent investors from making well-informed decisions.

Another cognitive bias that can influence cryptocurrency trading is the herd mentality. This bias occurs when investors follow the actions of the crowd without conducting their research or analysis. This can lead to a situation where investors buy or sell cryptocurrencies based on the actions of others, rather than on fundamental market factors.

Fear of missing out (FOMO) is yet another cognitive bias that can impact cryptocurrency trading. This bias occurs when investors make decisions based on the fear of missing out on potential profits, rather than on a rational analysis of the market. This can lead to impulsive decision-making and a higher risk of losses.

Overall, being aware of these cognitive biases and actively working to mitigate their influence can help investors make more rational and informed decisions when trading cryptocurrencies. By staying vigilant and conducting thorough research, investors can avoid falling victim to these biases and increase their chances of success in the cryptocurrency market.

The role of social proof in shaping investor behavior

Social proof plays a significant role in influencing investor behavior in the realm of cryptocurrency investing. When investors see others making successful investments in a particular cryptocurrency, they are more likely to follow suit. This phenomenon is driven by the psychological principle of social validation, where individuals look to the actions of others to determine the correct course of action.

One of the key ways social proof manifests in cryptocurrency investing is through the use of social media platforms. Investors often turn to platforms like Twitter, Reddit, and Telegram to gauge market sentiment and see what others are saying about specific cryptocurrencies. Positive comments and success stories can create a sense of FOMO (fear of missing out), prompting investors to jump on the bandwagon and invest in the same assets.

Additionally, the presence of influencers and thought leaders in the cryptocurrency space can further amplify the effects of social proof. When well-known figures endorse a particular cryptocurrency or share their investment strategies, their followers are likely to take notice and potentially mirror their actions. This can create a snowball effect, with more and more investors piling into the same assets based on the recommendations of these influencers.

Managing stress and anxiety in the world of cryptocurrency

Investing in cryptocurrency can be a stressful and anxiety-inducing experience for many individuals. The volatile nature of the market, coupled with the constant fluctuations in prices, can lead to a great deal of uncertainty and fear. It is essential to manage stress and anxiety effectively to make informed decisions and avoid making impulsive choices that could result in financial losses.

One way to manage stress and anxiety in the world of cryptocurrency is to set realistic goals and expectations. By establishing clear objectives and timelines for your investments, you can reduce the pressure you feel to constantly monitor the market and make quick decisions. This can help you maintain a sense of control and focus on the long-term growth potential of your investments.

Another effective strategy for managing stress and anxiety in cryptocurrency investing is to practice mindfulness and stay present in the moment. By focusing on the here and now, you can avoid getting caught up in the fear of missing out or the temptation to chase quick profits. Mindfulness can help you make rational decisions based on facts and analysis, rather than emotions and impulses.

Additionally, it is crucial to diversify your cryptocurrency portfolio to minimize risk and protect yourself from market volatility. By spreading your investments across different assets, you can reduce the impact of any single asset’s performance on your overall portfolio. Diversification can help you weather market fluctuations and maintain a more stable investment strategy.

Finally, seeking support from a financial advisor or therapist can be beneficial for managing stress and anxiety in cryptocurrency investing. A professional can provide guidance on investment strategies, help you navigate market uncertainties, and offer coping mechanisms for dealing with the emotional challenges of investing. By seeking support, you can gain valuable insights and tools to help you make more informed and confident decisions in the world of cryptocurrency.

The psychology behind FOMO and FUD in the crypto market

The psychology behind Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD) in the cryptocurrency market plays a significant role in influencing investors’ decisions. FOMO is the fear of missing out on potential profits when seeing others making successful trades or investments. This fear can lead investors to make impulsive decisions without conducting proper research or analysis, ultimately resulting in losses.

On the other hand, FUD refers to the fear, uncertainty, and doubt that can arise from negative news or market volatility. This can cause investors to panic sell or avoid investing altogether, missing out on potential opportunities for growth. Understanding the psychological factors behind FOMO and FUD can help investors make more rational and informed decisions when trading cryptocurrencies.