Understanding the Basics of Cryptocurrency

- What is Cryptocurrency?

- The History of Cryptocurrency

- How Cryptocurrency Works

- Popular Cryptocurrencies to Know

- Benefits of Using Cryptocurrency

- Risks and Challenges of Cryptocurrency

What is Cryptocurrency?

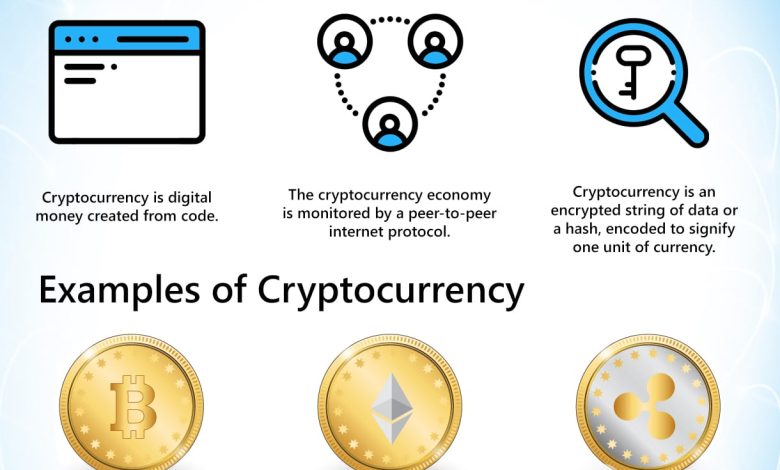

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. This technology ensures that transactions are secure, transparent, and immutable.

One of the key features of cryptocurrency is its decentralized nature, meaning that it is not controlled by any central authority such as a government or financial institution. Instead, transactions are verified by a network of computers, known as nodes, which work together to maintain the integrity of the blockchain.

Cryptocurrencies can be used for a variety of purposes, including online purchases, investment, and remittances. They offer a level of anonymity and privacy that is not typically found with traditional forms of payment. Additionally, cryptocurrencies are often seen as a hedge against inflation and economic instability.

Bitcoin, created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto, was the first cryptocurrency and remains the most well-known and widely used. Since then, thousands of other cryptocurrencies have been created, each with its own unique features and use cases.

Overall, cryptocurrency represents a new and innovative way of conducting financial transactions in the digital age. Its decentralized nature, security features, and potential for growth make it an attractive option for those looking to diversify their assets and participate in the evolving landscape of digital finance.

The History of Cryptocurrency

Cryptocurrency has a rich history that dates back to the late 20th century. The concept of digital currency was first introduced in the 1980s, but it wasn’t until the early 2000s that the first decentralized cryptocurrency, Bitcoin, was created by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin revolutionized the financial world by introducing a peer-to-peer electronic cash system that operates without a central authority.

Following the success of Bitcoin, numerous alternative cryptocurrencies, or altcoins, were developed, each with its unique features and functionalities. These altcoins aimed to address some of the limitations of Bitcoin, such as scalability and transaction speed. Some popular altcoins include Ethereum, Ripple, and Litecoin.

The rise of cryptocurrencies sparked a global phenomenon, with more people and businesses adopting digital currencies for various transactions. The underlying technology behind cryptocurrencies, blockchain, has also gained significant attention for its potential applications beyond digital currencies. Blockchain is a decentralized and distributed ledger that records all transactions across a network of computers, ensuring transparency and security.

As the popularity of cryptocurrencies continues to grow, governments and regulatory bodies around the world have started to take notice. Some countries have embraced cryptocurrencies and blockchain technology, while others have imposed restrictions or outright bans. The regulatory landscape for cryptocurrencies remains complex and continues to evolve as governments grapple with how to regulate this new form of digital asset.

Overall, the history of cryptocurrency is a testament to the power of innovation and technology to disrupt traditional financial systems. Cryptocurrencies have the potential to revolutionize the way we think about money and transactions, offering a decentralized and secure alternative to traditional fiat currencies. As the cryptocurrency market continues to mature, it will be interesting to see how this technology continues to shape the future of finance.

How Cryptocurrency Works

Cryptocurrency operates on a decentralized technology called blockchain. This digital ledger records all transactions across a network of computers. Each transaction is encrypted and added to a block, which is then linked to the previous block, creating a chain of blocks – hence the name blockchain. This process ensures transparency and security, as each transaction is verified by multiple computers, making it nearly impossible to alter or hack.

When a user initiates a cryptocurrency transaction, it is broadcasted to the network of computers for validation. Miners, who are individuals or groups with powerful computers, compete to solve complex mathematical puzzles to validate the transaction. The first miner to solve the puzzle adds the block to the blockchain and is rewarded with newly minted cryptocurrency. This process, known as mining, not only validates transactions but also creates new coins in the system.

Cryptocurrencies are stored in digital wallets, which are secured with private keys. These keys are used to sign transactions, providing proof of ownership and allowing users to access their funds. It is crucial to keep these keys secure, as losing them means losing access to the cryptocurrency stored in the wallet. Additionally, users can transfer cryptocurrency to others by sharing their public key, which acts as an address for receiving funds.

The value of cryptocurrencies is determined by supply and demand in the market. Unlike traditional currencies issued by governments, cryptocurrencies are not backed by any physical asset. Instead, their value is based on factors such as adoption, utility, and market speculation. This volatility can lead to significant price fluctuations, making cryptocurrency trading a high-risk investment. However, many people are drawn to cryptocurrencies for their potential to provide financial freedom and privacy in an increasingly digital world.

Popular Cryptocurrencies to Know

When it comes to popular cryptocurrencies to know, there are several key players in the market that have gained significant attention and adoption. These digital currencies have unique features and use cases that set them apart from one another.

- Bitcoin: As the first cryptocurrency ever created, Bitcoin remains the most well-known and widely used digital asset. It is often referred to as “digital gold” and is used for various purposes, including online transactions and investment.

- Ethereum: Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Its native cryptocurrency is called Ether (ETH) and is used to power transactions on the network.

- Ripple: Ripple is a digital payment protocol that aims to facilitate fast and low-cost cross-border transactions. Its native cryptocurrency, XRP, is used as a bridge currency for facilitating these transactions.

- Litecoin: Created by Charlie Lee, Litecoin is often referred to as the “silver to Bitcoin’s gold.” It is a peer-to-peer cryptocurrency that enables instant, near-zero cost payments to anyone in the world.

- Cardano: Cardano is a blockchain platform that aims to provide a more secure and scalable infrastructure for the development of decentralized applications and smart contracts. Its native cryptocurrency is called ADA.

These are just a few examples of the popular cryptocurrencies that are worth knowing about in the ever-evolving world of digital assets. Each of these cryptocurrencies has its own unique value proposition and potential for growth in the future.

Benefits of Using Cryptocurrency

Cryptocurrency offers several benefits that make it an attractive option for individuals and businesses alike. One of the key advantages of using cryptocurrency is the high level of security it provides. Transactions made with cryptocurrency are encrypted and secure, reducing the risk of fraud and identity theft. Additionally, cryptocurrency transactions are decentralized, meaning they are not controlled by any central authority, such as a bank or government. This decentralization helps to reduce fees associated with traditional banking systems.

Another benefit of using cryptocurrency is the speed and efficiency of transactions. With traditional banking systems, international transfers can take days to process, while cryptocurrency transactions can be completed in a matter of minutes. This speed is especially beneficial for businesses that need to make quick payments to suppliers or partners around the world.

Furthermore, cryptocurrency offers greater privacy and anonymity compared to traditional forms of payment. While all cryptocurrency transactions are recorded on a public ledger, the identities of the parties involved are encrypted, providing a level of privacy that is not possible with traditional banking systems. This anonymity can be particularly appealing to individuals who value their privacy and want to keep their financial transactions confidential.

Risks and Challenges of Cryptocurrency

When it comes to cryptocurrency, there are several risks and challenges that investors and users should be aware of. While the potential for high returns is enticing, it is important to understand the potential downsides as well.

One of the main risks of cryptocurrency is its volatility. Prices can fluctuate wildly in a short period of time, leading to potential losses for investors. This volatility is due to the relatively small market size of cryptocurrencies compared to traditional assets.

Another challenge is the lack of regulation in the cryptocurrency market. This can make it difficult to protect against fraud, hacking, and other illegal activities. Investors may also have limited recourse if they fall victim to scams or lose their funds due to security breaches.

Additionally, the technology behind cryptocurrencies is complex and constantly evolving. This can make it difficult for the average person to understand how cryptocurrency works and how to securely store and transact with it.

Overall, while cryptocurrency has the potential to revolutionize the financial industry, it is important to approach it with caution and be aware of the risks and challenges involved.