The Impact of Regulatory News on the Crypto Market

- The Role of Regulatory News in Shaping Crypto Market Trends

- How Government Regulations Influence Cryptocurrency Prices

- Analyzing the Market Response to Regulatory Updates in the Crypto Industry

- Implications of Regulatory Changes on Investor Sentiment in the Cryptocurrency Market

- Exploring the Relationship Between Regulatory News and Volatility in Cryptocurrencies

- The Ripple Effect: How Regulatory News Can Drive Price Swings in the Crypto Market

The Role of Regulatory News in Shaping Crypto Market Trends

Regulatory news plays a crucial role in shaping trends within the cryptocurrency market. When government agencies or regulatory bodies announce new policies or guidelines related to cryptocurrencies, it can have a significant impact on the prices and overall sentiment of the market. Investors and traders closely monitor these developments as they can signal potential changes in the regulatory environment that may affect the value of their investments.

For example, news of a country banning or restricting the use of cryptocurrencies can lead to a sharp decline in prices as investors fear the impact on adoption and liquidity. On the other hand, positive regulatory news such as the approval of a cryptocurrency exchange-traded fund (ETF) can boost market confidence and drive prices higher. The uncertainty surrounding regulatory decisions can create volatility in the market, making it essential for participants to stay informed and react quickly to new developments.

Regulatory news can also influence market trends by shaping public perception of cryptocurrencies. Negative news stories about regulatory crackdowns or security breaches can erode trust in the market, leading to a decrease in demand and prices. Conversely, positive news such as regulatory endorsements or partnerships with established financial institutions can help legitimize cryptocurrencies in the eyes of the public, attracting new investors and driving prices up.

How Government Regulations Influence Cryptocurrency Prices

Government regulations play a significant role in influencing the prices of cryptocurrencies. When regulatory news is announced, it can have a direct impact on the market, causing prices to fluctuate rapidly. This is because regulations can either promote or hinder the adoption and use of cryptocurrencies, which in turn affects their value.

For example, if a government announces strict regulations on the use of cryptocurrencies, such as banning their use for certain transactions or imposing heavy taxes on crypto-related activities, this can lead to a decrease in demand for cryptocurrencies. As a result, prices may drop as investors become wary of the risks associated with investing in a regulated market.

On the other hand, if a government introduces favorable regulations that promote the use of cryptocurrencies, such as providing legal clarity on their status or offering tax incentives for crypto-related businesses, this can boost confidence in the market. As a result, prices may rise as more investors see the potential for growth and innovation in a regulated environment.

Overall, government regulations can create both positive and negative sentiment in the crypto market, leading to price fluctuations based on how investors perceive the impact of regulations on the future of cryptocurrencies. It is essential for investors to stay informed about regulatory developments and adapt their investment strategies accordingly to navigate the volatile crypto market successfully.

Analyzing the Market Response to Regulatory Updates in the Crypto Industry

When it comes to **analyzing** the **market response** to **regulatory updates** in the **crypto industry**, it is crucial to consider the **impact** that such news can have on **cryptocurrency prices** and **investor sentiment**. **Regulatory changes** can **significantly affect** the **volatility** of **digital assets**, leading to **sharp fluctuations** in **prices** and **trading volumes**.

One **common response** to **regulatory updates** is **heightened uncertainty** among **investors**, which can result in **sell-offs** and **price declines**. **Traders** may also **react** by **adjusting their positions** or **hedging** against **potential risks** associated with **new regulations**. **Market sentiment** can **quickly shift** based on **perceptions** of how **regulators** will **impact** the **crypto market**.

On the other hand, **positive regulatory news** can **boost confidence** in the **industry** and **drive prices** higher. **Clear guidelines** and **supportive measures** from **regulators** can **encourage** **institutional investors** to **enter** the **market**, leading to **increased demand** for **cryptocurrencies**.

Implications of Regulatory Changes on Investor Sentiment in the Cryptocurrency Market

Regulatory changes have a significant impact on investor sentiment in the cryptocurrency market. When news of new regulations or crackdowns on crypto activities emerges, it often leads to a sense of uncertainty and fear among investors. This uncertainty can result in increased volatility and price fluctuations in the market as investors react to the news.

Investors may become more cautious and hesitant to invest in cryptocurrencies when faced with regulatory uncertainty. They may fear potential legal repercussions or restrictions that could affect their investments. This fear can lead to a decrease in trading volume and liquidity in the market as investors adopt a wait-and-see approach.

On the other hand, some investors may see regulatory changes as a positive development for the cryptocurrency market. Clear regulations can provide a sense of legitimacy and security, attracting institutional investors and mainstream adoption. This positive sentiment can lead to increased investment and market growth in the long run.

Overall, the implications of regulatory changes on investor sentiment in the cryptocurrency market are complex and multifaceted. It is essential for investors to stay informed about regulatory developments and adapt their investment strategies accordingly to navigate the ever-changing landscape of the crypto market.

Exploring the Relationship Between Regulatory News and Volatility in Cryptocurrencies

Exploring the relationship between regulatory news and volatility in cryptocurrencies is crucial for understanding the dynamics of the crypto market. Regulatory news, such as announcements of new regulations or crackdowns on illegal activities, can have a significant impact on the prices of cryptocurrencies. This impact is often reflected in increased volatility, as investors react to the uncertainty and potential changes in the regulatory environment.

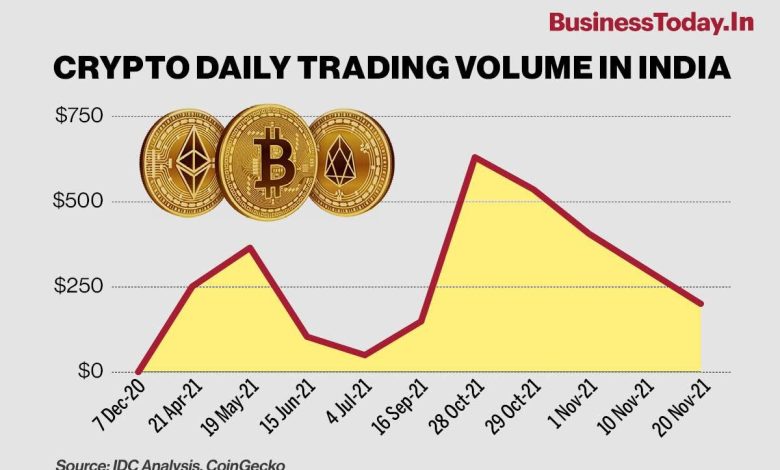

Studies have shown that regulatory news can lead to sharp price movements in cryptocurrencies, with prices sometimes experiencing large swings in a short period of time. This volatility can present both opportunities and risks for traders and investors, as it can create the potential for significant profits or losses. Understanding how regulatory news affects volatility can help market participants make more informed decisions and manage their risk exposure effectively.

By analyzing the relationship between regulatory news and volatility in cryptocurrencies, researchers can gain insights into the underlying factors driving price movements in the crypto market. This analysis can help identify patterns and trends that may inform future trading strategies and risk management practices. Additionally, understanding the impact of regulatory news on volatility can provide valuable information for policymakers and regulators seeking to develop more effective frameworks for overseeing the crypto market.

The Ripple Effect: How Regulatory News Can Drive Price Swings in the Crypto Market

Regulatory news has a significant impact on the cryptocurrency market, often leading to price swings and volatility. When regulatory bodies announce new policies or regulations related to cryptocurrencies, it can create a ripple effect throughout the market. Investors and traders closely monitor these developments as they can have a direct impact on the value of digital assets.

One of the key reasons why regulatory news drives price swings in the crypto market is due to the uncertainty it creates. Uncertainty around how new regulations will be implemented or enforced can lead to panic selling or buying, causing prices to fluctuate rapidly. This uncertainty can also lead to increased market speculation and heightened emotions among market participants.

Moreover, regulatory news can also influence market sentiment. Positive regulatory developments, such as the approval of a cryptocurrency ETF or the recognition of digital assets as legal tender, can boost investor confidence and drive prices higher. On the other hand, negative news, such as a ban on cryptocurrency trading or stricter regulations, can lead to a sell-off and price decline.

It is essential for investors and traders to stay informed about regulatory news and developments in the cryptocurrency space. By keeping a close eye on regulatory announcements and understanding how they can impact the market, market participants can make more informed trading decisions and better navigate the volatility that often accompanies regulatory news.