How to Identify and Avoid Cryptocurrency Scams

- Understanding the common types of cryptocurrency scams

- Tips for spotting red flags in cryptocurrency investment opportunities

- Researching the legitimacy of a cryptocurrency project before investing

- Protecting your personal information and assets from scammers

- Avoiding Ponzi schemes and other fraudulent schemes in the cryptocurrency space

- Seeking advice from trusted sources to avoid falling victim to cryptocurrency scams

Understanding the common types of cryptocurrency scams

When it comes to cryptocurrency scams, it’s essential to understand the common types that exist in the digital world. By being aware of these scams, you can better protect yourself from falling victim to fraudulent schemes.

- Phishing Scams: Phishing scams involve fraudulent emails, websites, or messages that appear to be from a legitimate source, such as a cryptocurrency exchange or wallet provider. These scams often trick individuals into providing their sensitive information, such as login credentials or private keys, which can then be used to steal their funds.

- Ponzi Schemes: Ponzi schemes promise high returns on investments but operate by using funds from new investors to pay returns to earlier investors. Eventually, the scheme collapses when there are not enough new investors to sustain it, leaving many participants with significant financial losses.

- Initial Coin Offering (ICO) Scams: ICO scams involve fraudulent cryptocurrency projects that raise funds through an initial coin offering. These projects often make false promises about their technology or potential returns on investment, only to disappear with investors’ funds once the ICO is complete.

- Impersonation Scams: Impersonation scams involve individuals pretending to be someone else, such as a well-known figure in the cryptocurrency industry, to deceive others into sending them funds. These scams often occur on social media platforms, where scammers create fake accounts to trick users into believing they are interacting with a legitimate person.

By familiarizing yourself with these common types of cryptocurrency scams, you can be better equipped to identify and avoid them. Remember to always exercise caution when investing in or interacting with cryptocurrencies, and never hesitate to seek advice from trusted sources if you are unsure about a particular opportunity.

Tips for spotting red flags in cryptocurrency investment opportunities

When considering cryptocurrency investment opportunities, it is crucial to be vigilant and watch out for red flags that may indicate a potential scam. Here are some tips to help you spot these warning signs:

- Check for unrealistic promises of high returns with little to no risk. If an investment opportunity sounds too good to be true, it probably is.

- Research the background of the individuals or companies behind the cryptocurrency. Look for transparency and a track record of success.

- Beware of pressure tactics to invest quickly or urgently. Scammers often try to create a sense of urgency to prevent you from conducting proper due diligence.

- Look out for poor communication or lack of responsiveness from the investment opportunity. Legitimate projects should be open to answering questions and providing information.

- Be cautious of unregulated or anonymous cryptocurrencies. Lack of regulation can make it easier for scammers to operate without consequences.

By staying alert and being aware of these red flags, you can protect yourself from falling victim to cryptocurrency scams. Remember to always conduct thorough research and seek advice from financial professionals before making any investment decisions.

Researching the legitimacy of a cryptocurrency project before investing

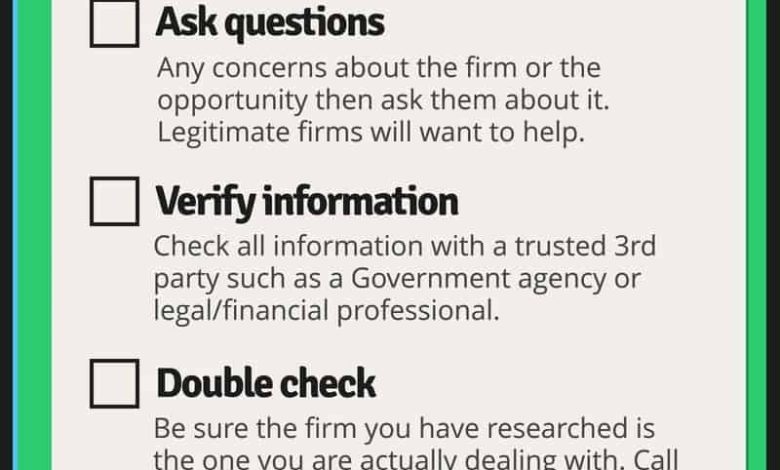

When considering investing in a cryptocurrency project, it is crucial to conduct thorough research to verify its legitimacy. There are several steps you can take to ensure that you are not falling victim to a scam.

One of the first things you should do is to examine the team behind the project. Look into their backgrounds, experience, and credibility in the cryptocurrency space. **Check** if they have been involved in any previous projects and whether those projects were successful. This information can give you insight into the team’s capabilities and intentions.

Next, **analyze** the whitepaper of the cryptocurrency project. The whitepaper should outline the problem the project aims to solve, its proposed solution, the technology behind it, and the roadmap for development. **Ensure** that the whitepaper is detailed, well-written, and makes sense. **Look** for any red flags or inconsistencies that could indicate a potential scam.

Furthermore, **research** the partnerships and collaborations of the cryptocurrency project. **Verify** whether the project has established relationships with reputable companies or organizations in the industry. **This** can add credibility to the project and increase the likelihood of its success.

Additionally, **examine** the community and social media presence of the cryptocurrency project. **Engage** with the community to get a sense of the project’s reputation and how active and supportive its community is. **Scour** social media platforms for any negative feedback, complaints, or warnings about the project.

By taking these steps and conducting thorough research, you can **mitigate** the risk of falling victim to a cryptocurrency scam. Remember to always be cautious and skeptical when considering investing in a new project, and never hesitate to seek advice from experts in the field.

Protecting your personal information and assets from scammers

Protecting your personal information and assets from scammers is crucial in the world of cryptocurrency. Here are some tips to help you stay safe:

- Be cautious about sharing personal information online, especially on social media platforms where scammers may try to gather information about you.

- Use strong, unique passwords for all your cryptocurrency accounts to prevent unauthorized access.

- Avoid clicking on suspicious links or emails that could lead to phishing scams designed to steal your information.

- Keep your cryptocurrency assets in secure wallets that offer features like two-factor authentication and encryption.

- Stay informed about the latest scams and security threats in the cryptocurrency space to protect yourself from falling victim.

By following these tips and staying vigilant, you can reduce the risk of being targeted by scammers and keep your personal information and assets safe in the world of cryptocurrency.

Avoiding Ponzi schemes and other fraudulent schemes in the cryptocurrency space

When it comes to investing in cryptocurrency, it is crucial to be aware of the potential risks associated with fraudulent schemes such as Ponzi schemes. These schemes often promise high returns with little to no risk, but in reality, they rely on new investors’ money to pay returns to earlier investors. This unsustainable model eventually collapses, leaving many investors with significant losses.

To avoid falling victim to Ponzi schemes and other fraudulent activities in the cryptocurrency space, it is essential to conduct thorough research before investing. Look for red flags such as guaranteed returns, complex investment strategies that are difficult to understand, and pressure to invest quickly. Additionally, be wary of individuals or companies that promise unrealistic profits or use aggressive marketing tactics to lure in investors.

One way to protect yourself from falling for these scams is to only invest in reputable cryptocurrencies and platforms that have a track record of transparency and security. Before making any investment, take the time to verify the legitimacy of the project and the individuals behind it. Look for reviews from other investors, check for any regulatory actions or warnings, and trust your instincts if something feels off.

Seeking advice from trusted sources to avoid falling victim to cryptocurrency scams

When it comes to navigating the world of cryptocurrency, seeking advice from **trusted sources** is crucial in order to avoid falling victim to scams. **Trusted sources** can include financial advisors, reputable websites, and **crypto** experts who have a proven track record in the industry. By consulting with these **reliable** sources, you can gain valuable insights and **guidance** on how to identify and steer clear of potential scams.

One of the best ways to **protect** yourself from falling prey to **cryptocurrency scams** is to stay informed and educated about the latest **trends** and developments in the market. By keeping up to date with **news** articles, **blogs**, and **forums** related to **cryptocurrency**, you can **empower** yourself with the knowledge needed to make informed decisions and **spot** potential red flags.

Additionally, it’s important to exercise caution and **conduct** thorough research before **investing** in any **cryptocurrency** project or **platform**. Be wary of **promises** of high returns with little to no risk, as these are often **hallmarks** of **scams**. Always **verify** the legitimacy of a **cryptocurrency** project by checking for **reviews**, **ratings**, and **feedback** from other **investors**.

By taking the time to seek advice from **trusted sources** and staying informed about the **cryptocurrency** market, you can **significantly** reduce your risk of falling victim to **scams**. Remember, **knowledge** is power when it comes to **protecting** your **investments** in the world of **cryptocurrency**.