Cryptocurrency Forks: What They Are and How They Work

- Understanding the Basics of Cryptocurrency Forks

- Exploring the Different Types of Cryptocurrency Forks

- The Impact of Forks on the Cryptocurrency Community

- Navigating the Risks and Rewards of Forking

- How Forks Can Lead to Innovation in the Crypto Space

- A Step-by-Step Guide to Participating in a Cryptocurrency Fork

Understanding the Basics of Cryptocurrency Forks

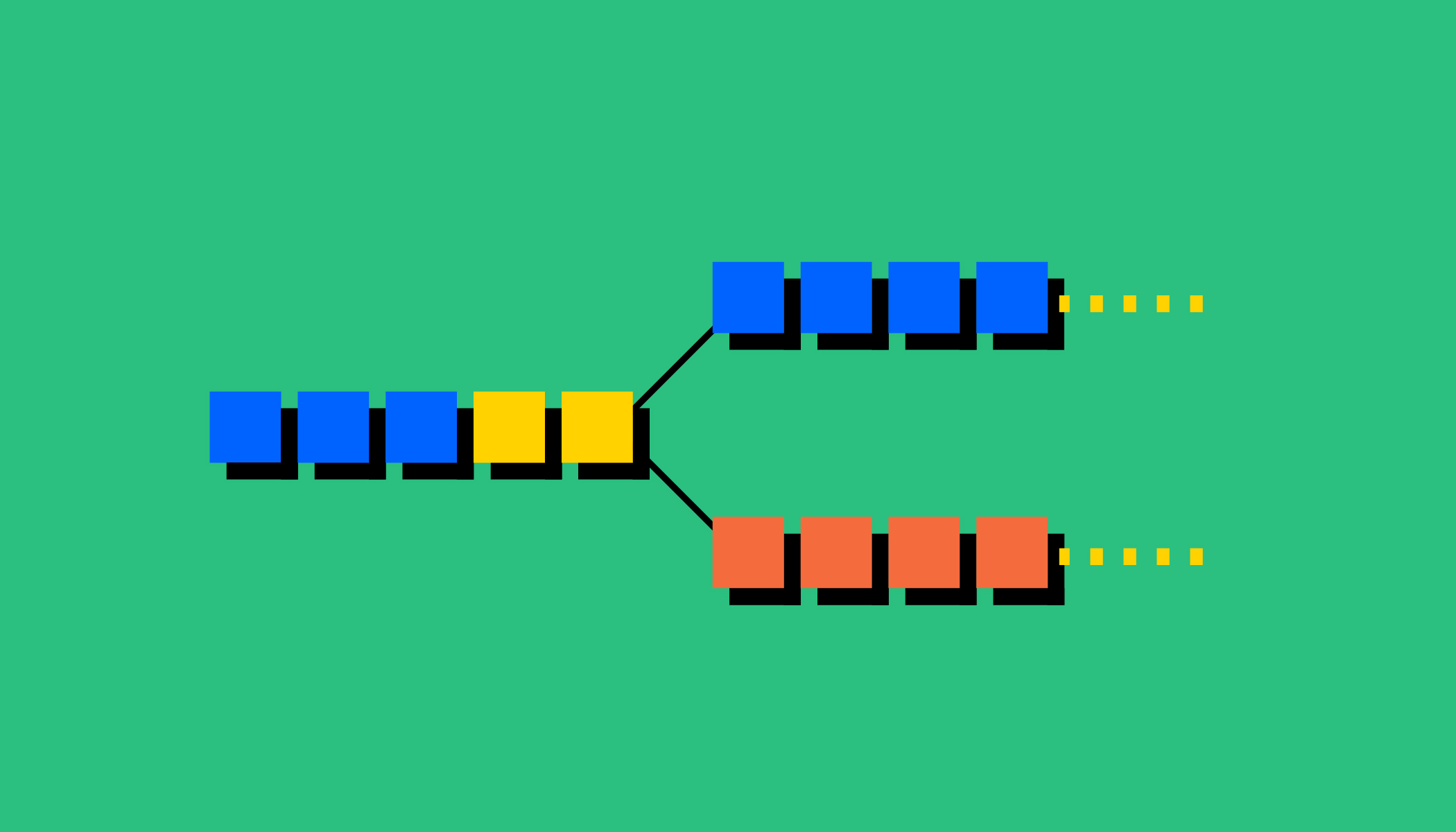

Cryptocurrency forks are a common occurrence in the digital currency world. A fork happens when a blockchain splits into two separate paths, creating two different versions of the original cryptocurrency. This can occur for various reasons, such as disagreements among developers, changes in the protocol, or updates to the software.

There are two main types of cryptocurrency forks: hard forks and soft forks. A hard fork is a permanent split from the original blockchain, resulting in two separate networks with different rules. On the other hand, a soft fork is a temporary divergence that is compatible with the original blockchain, meaning that nodes running the old software can still validate transactions on the new network.

When a fork occurs, holders of the original cryptocurrency usually receive an equal amount of the new forked coins. This is known as airdropping and is a way to compensate users for any potential losses resulting from the fork. However, it is essential to be cautious when dealing with forked coins, as they may not have the same value or security as the original cryptocurrency.

Exploring the Different Types of Cryptocurrency Forks

Cryptocurrency forks come in different types, each with its own unique characteristics and implications for the blockchain network. Understanding these variations is crucial for investors and enthusiasts alike.

One common type of cryptocurrency fork is a **soft fork**. This occurs when a change is made to the blockchain protocol that is backward-compatible, meaning that nodes that have not upgraded can still operate on the network. Soft forks are typically implemented to improve the network’s efficiency or security without causing a split in the blockchain.

On the other hand, a **hard fork** is a more drastic type of fork that is not backward-compatible. This means that nodes that have not upgraded to the new protocol will no longer be able to participate in the network. Hard forks often result in the creation of a new cryptocurrency, as the original blockchain splits into two separate chains.

Another type of fork is a **planned fork**, which is a fork that is scheduled in advance and typically involves a significant upgrade to the network. Planned forks are usually well-publicized and aim to garner support from the community before implementation.

In contrast, an **unplanned fork** is a fork that occurs unexpectedly due to a disagreement within the community or a software bug. Unplanned forks can lead to confusion and uncertainty in the cryptocurrency market, as users may not be prepared for the sudden changes.

Overall, exploring the different types of cryptocurrency forks can provide valuable insights into how these events shape the blockchain ecosystem. Whether it’s a soft fork, hard fork, planned fork, or unplanned fork, each type plays a unique role in the evolution of cryptocurrencies.

The Impact of Forks on the Cryptocurrency Community

When it comes to the impact of forks on the cryptocurrency community, it is essential to understand that forks can have both positive and negative effects. On the one hand, forks can lead to the creation of new and innovative cryptocurrencies, providing users with more options and opportunities for investment. This can help to increase diversity within the cryptocurrency market and promote healthy competition among different projects.

On the other hand, forks can also create confusion and uncertainty within the community. When a cryptocurrency undergoes a fork, it can split the community into different factions, each supporting a different version of the currency. This can lead to disagreements and conflicts among users, developers, and miners, potentially harming the overall reputation and stability of the cryptocurrency.

Overall, forks play a significant role in shaping the cryptocurrency landscape. They have the potential to drive innovation and growth, but they also come with risks and challenges that need to be carefully managed. By staying informed and understanding the implications of forks, members of the cryptocurrency community can navigate these changes effectively and make informed decisions about their investments and participation in the market.

Navigating the Risks and Rewards of Forking

When considering the **risks** and **rewards** of **forking** in the world of **cryptocurrency**, it is essential to weigh the potential outcomes carefully. **Forking** can lead to **divergent** paths for a **blockchain**, with each **fork** having its own set of **benefits** and **challenges**.

One **risk** of **forking** is the potential for **community** **divisions**. When a **blockchain** **forks**, **community** **members** may have differing opinions on which **fork** to support, leading to **conflict** and **uncertainty**. This **division** can **weaken** the **overall** **network** and **impact** the **value** of the **cryptocurrency**.

On the other hand, there are **rewards** to be **gained** from **forking** as well. **Forking** can **allow** for **innovation** and **improvement** within a **blockchain**, **resulting** in a **more** **efficient** and **effective** **system**. **Investors** who **support** the **right** **fork** can **potentially** **profit** from **increased** **value** and **utility**.

**Navigating** the **risks** and **rewards** of **forking** requires **careful** **consideration** and **research**. **Investors** should **thoroughly** **analyze** the **potential** **outcomes** of a **fork** before **deciding** which **path** to **take**. By **understanding** the **implications** of **forking**, **investors** can **make** **informed** **decisions** that **align** with their **financial** **goals**.

How Forks Can Lead to Innovation in the Crypto Space

One of the interesting aspects of cryptocurrency forks is how they can lead to innovation in the crypto space. When a fork occurs, it can result in the creation of a new cryptocurrency with unique features and capabilities. This can spark creativity and competition among developers, driving them to come up with new ideas and improvements to the original blockchain.

By forking a cryptocurrency, developers have the opportunity to experiment with different consensus mechanisms, governance structures, and scalability solutions. This can result in the birth of innovative projects that address the limitations of the original blockchain and offer new functionalities to users.

Furthermore, forks can also lead to the creation of new communities and ecosystems around the forked cryptocurrency. This can foster collaboration and knowledge sharing among developers, leading to further advancements in the crypto space.

A Step-by-Step Guide to Participating in a Cryptocurrency Fork

Participating in a cryptocurrency fork can be an exciting opportunity for investors to potentially benefit from a new digital asset. Here is a step-by-step guide to help you navigate the process:

- Educate Yourself: Before participating in a cryptocurrency fork, it is essential to educate yourself on the specific details of the fork. Understand the reasons behind the fork, the changes being implemented, and how it may impact your existing holdings.

- Secure Your Funds: Make sure your cryptocurrency holdings are stored in a secure wallet that supports the fork. This will ensure that you can access your new coins once the fork occurs.

- Monitor Announcements: Stay informed about the fork by following official announcements from the cryptocurrency project. This will help you stay up to date on any changes or instructions regarding the fork.

- Take Action: When the fork occurs, follow the instructions provided by the cryptocurrency project to claim your new coins. This may involve transferring your funds to a specific wallet or taking other specified actions.

- Be Patient: After participating in a cryptocurrency fork, it may take some time for the new coins to be credited to your account. Be patient and allow the process to unfold before making any further decisions.

By following these steps, you can effectively participate in a cryptocurrency fork and potentially benefit from the new digital assets that are created as a result.