The Impact of Blockchain on the Insurance Industry

- The Rise of Blockchain Technology in Insurance

- Revolutionizing Claims Processing with Blockchain

- Enhancing Security and Transparency in Insurance with Blockchain

- Streamlining Underwriting Processes through Blockchain

- The Role of Smart Contracts in Insurance Industry

- Challenges and Opportunities of Implementing Blockchain in Insurance

The Rise of Blockchain Technology in Insurance

Blockchain technology has been making significant strides in the insurance industry, revolutionizing the way insurance companies operate and interact with their customers. The rise of blockchain in insurance has brought about increased transparency, security, and efficiency in various processes.

One of the key benefits of blockchain technology in insurance is its ability to create a secure and immutable record of transactions. This helps in reducing fraud and ensuring that all parties involved in a transaction can trust the information stored on the blockchain. Additionally, blockchain allows for faster and more streamlined claims processing, as all relevant information is readily available on the decentralized ledger.

Another advantage of blockchain technology in insurance is the automation of processes through smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This eliminates the need for intermediaries and reduces the risk of errors or disputes, ultimately leading to cost savings for insurance companies.

Furthermore, blockchain technology enables greater collaboration among different stakeholders in the insurance industry. By providing a shared platform for data exchange, blockchain facilitates smoother communication and data sharing between insurers, reinsurers, brokers, and customers. This interoperability leads to improved customer experiences and more personalized insurance products.

In conclusion, the rise of blockchain technology in insurance is reshaping the industry by enhancing security, efficiency, and collaboration. As more insurance companies adopt blockchain solutions, we can expect to see further innovations and improvements in the way insurance products and services are delivered to customers.

Revolutionizing Claims Processing with Blockchain

Blockchain technology is revolutionizing the insurance industry, particularly in the realm of claims processing. By leveraging blockchain, insurance companies can streamline and secure the claims process, leading to faster payouts and improved customer satisfaction.

One of the key benefits of using blockchain for claims processing is the transparency it provides. With blockchain, all parties involved in a claim can access a secure, shared ledger that records every transaction and communication. This transparency helps to reduce fraud and disputes, as all information is easily verifiable.

Additionally, blockchain technology allows for smart contracts to be implemented in the claims process. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This automation can help to expedite the claims process, ensuring that payouts are made quickly and accurately.

Furthermore, blockchain can improve the efficiency of claims processing by eliminating the need for manual paperwork and reducing the risk of errors. By digitizing and automating the claims process, insurance companies can save time and resources, ultimately leading to cost savings for both insurers and policyholders.

In conclusion, blockchain technology is transforming the way insurance companies handle claims processing. By increasing transparency, enabling smart contracts, and improving efficiency, blockchain is revolutionizing the insurance industry and enhancing the overall customer experience.

Enhancing Security and Transparency in Insurance with Blockchain

Blockchain technology is revolutionizing the insurance industry by enhancing security and transparency in various processes. By utilizing blockchain, insurance companies can improve data security, reduce fraud, and increase trust among stakeholders.

One of the key benefits of blockchain in insurance is its ability to create a tamper-proof record of transactions. This ensures that all data is secure and cannot be altered without consensus from the network. This level of security helps prevent fraudulent activities and ensures that all parties involved have access to accurate and transparent information.

Furthermore, blockchain enables smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation streamlines processes, reduces the need for intermediaries, and minimizes the risk of errors or disputes.

Overall, the implementation of blockchain in the insurance industry leads to increased efficiency, lower costs, and improved customer satisfaction. As more companies adopt this technology, the industry as a whole will benefit from enhanced security and transparency in all operations.

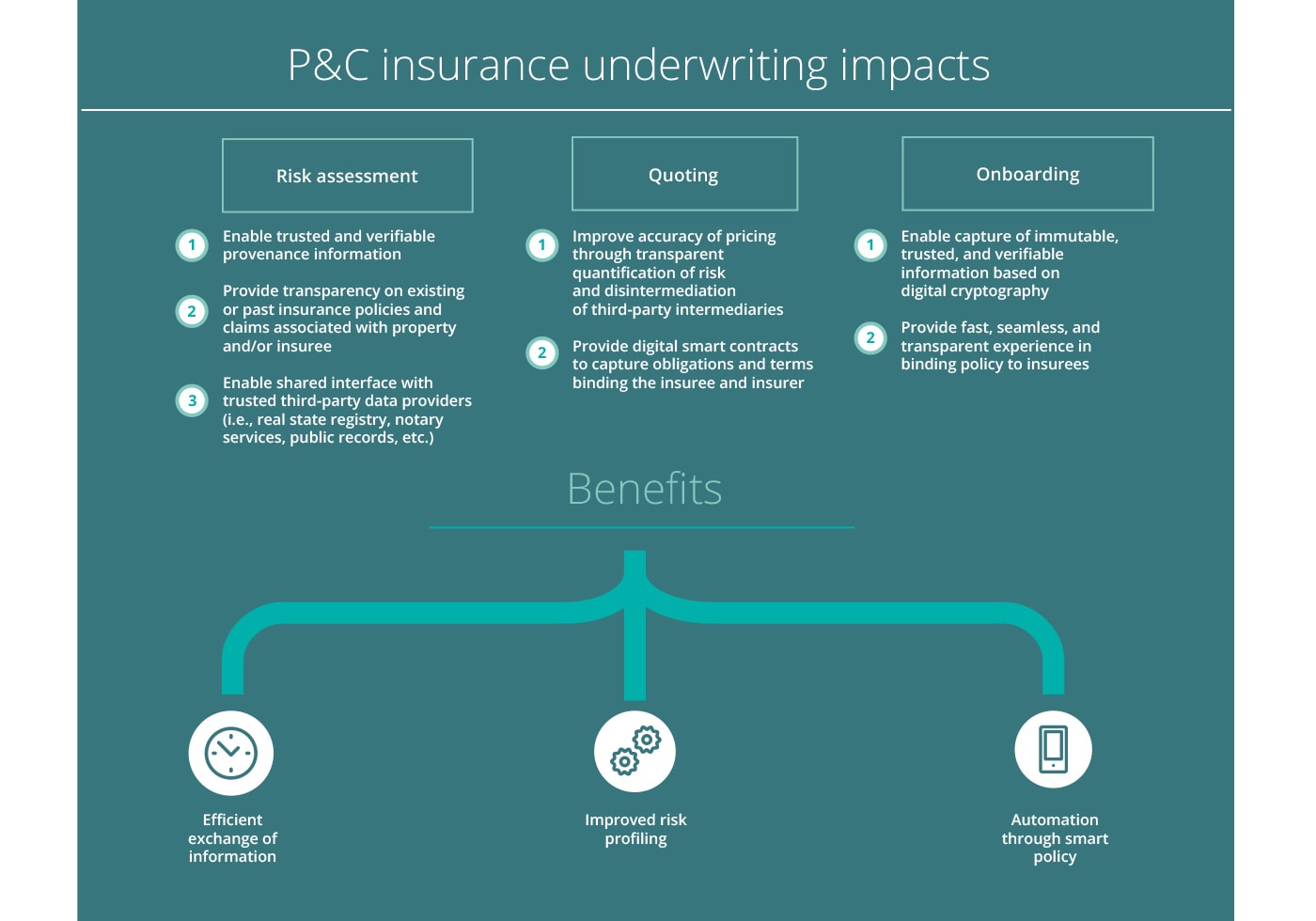

Streamlining Underwriting Processes through Blockchain

Blockchain technology has the potential to revolutionize the insurance industry by streamlining underwriting processes. By leveraging blockchain, insurers can automate and digitize the underwriting process, reducing paperwork and increasing efficiency. This technology allows for the secure and transparent sharing of data between insurers, reinsurers, and other stakeholders, leading to faster decision-making and improved risk assessment.

The Role of Smart Contracts in Insurance Industry

Smart contracts play a crucial role in revolutionizing the insurance industry by streamlining processes, reducing costs, and enhancing security. These self-executing contracts are stored on a blockchain network, ensuring transparency and immutability in insurance transactions.

One of the key benefits of smart contracts in the insurance sector is the automation of claims processing. By utilizing predefined rules and conditions, smart contracts can automatically trigger payments to policyholders when specific criteria are met, eliminating the need for manual intervention and reducing the risk of fraud.

Furthermore, smart contracts can also facilitate the verification of policyholder information through decentralized identity verification systems. This helps in reducing the administrative burden on insurance companies and ensures that only valid claims are processed.

Another advantage of smart contracts is their ability to enable parametric insurance, where payouts are triggered automatically based on predefined parameters such as weather conditions or seismic activity. This not only expedites the claims process but also provides policyholders with faster access to funds in times of need.

In conclusion, smart contracts are reshaping the insurance industry by introducing efficiency, transparency, and security into insurance operations. As blockchain technology continues to evolve, the adoption of smart contracts is expected to become more widespread, leading to a more streamlined and customer-centric insurance experience.

Challenges and Opportunities of Implementing Blockchain in Insurance

Implementing blockchain in the insurance industry presents both challenges and opportunities for companies looking to leverage this technology.

One of the main challenges is the complexity of integrating blockchain into existing systems and processes. This can require significant time and resources to ensure a smooth transition. Additionally, there may be resistance from employees who are unfamiliar with blockchain technology and may be hesitant to adopt it.

On the other hand, there are numerous opportunities that blockchain can offer to the insurance industry. One of the key benefits is increased transparency and security in transactions. Blockchain’s decentralized nature makes it difficult for fraudsters to manipulate data, reducing the risk of fraudulent claims and improving trust among stakeholders.

Furthermore, blockchain can streamline processes such as underwriting and claims processing, leading to faster and more efficient operations. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate these processes and reduce the need for manual intervention.

Overall, while there are challenges to overcome in implementing blockchain in insurance, the opportunities for increased efficiency, transparency, and security make it a promising technology for the industry to explore. By addressing these challenges and embracing the opportunities, insurance companies can stay ahead of the curve and remain competitive in a rapidly evolving market.