Cryptocurrency Adoption Around the World

- The Rise of Cryptocurrency Adoption Globally

- Factors Influencing Cryptocurrency Adoption in Various Countries

- Challenges and Opportunities for Cryptocurrency Adoption

- Regulatory Landscape Impacting Cryptocurrency Adoption

- Cryptocurrency Adoption Trends in Developing Economies

- The Future of Cryptocurrency Adoption: Predictions and Projections

The Rise of Cryptocurrency Adoption Globally

The rise of cryptocurrency adoption globally has been a significant trend in recent years. More and more people around the world are becoming interested in digital currencies as a means of investment, payment, and even as a store of value. This surge in cryptocurrency adoption can be attributed to several factors.

One of the main drivers of cryptocurrency adoption is the increasing awareness and understanding of blockchain technology that underpins these digital assets. As people become more familiar with how blockchain works and the benefits it offers in terms of security, transparency, and decentralization, they are more inclined to explore cryptocurrencies as an alternative to traditional financial systems.

Another factor contributing to the rise of cryptocurrency adoption is the growing acceptance of digital currencies by mainstream businesses and institutions. Major companies like PayPal, Tesla, and Visa have started to embrace cryptocurrencies as a form of payment, making it easier for consumers to use digital assets in their everyday transactions.

Furthermore, the increasing volatility of traditional financial markets and the ongoing economic uncertainty have also played a role in driving cryptocurrency adoption. Many people see digital currencies as a hedge against inflation and market instability, leading them to invest in cryptocurrencies as a way to diversify their portfolios and protect their wealth.

Factors Influencing Cryptocurrency Adoption in Various Countries

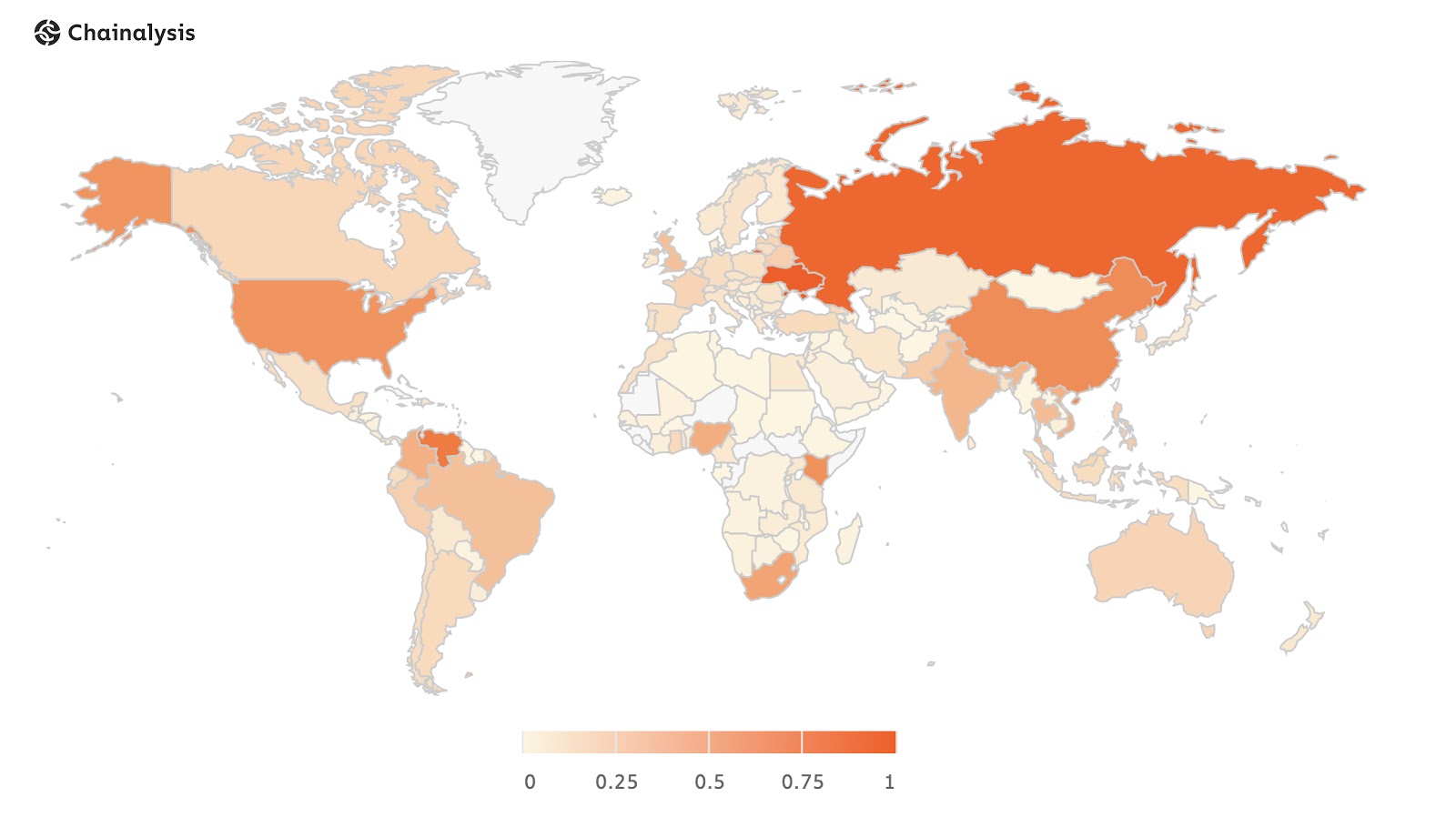

Factors influencing the adoption of cryptocurrency vary from country to country due to a combination of economic, regulatory, and cultural factors. In some countries, the high level of financial inclusion and technological infrastructure has led to a more rapid adoption of cryptocurrencies. On the other hand, countries with strict regulations or a lack of awareness about digital currencies may see slower adoption rates.

One of the key factors influencing cryptocurrency adoption is the level of government regulation. Countries with clear and supportive regulations for cryptocurrencies tend to see higher adoption rates as it provides a sense of security and legitimacy for investors and users. Conversely, countries with ambiguous or restrictive regulations may deter individuals and businesses from using cryptocurrencies.

Another factor that influences cryptocurrency adoption is the level of financial literacy in a country. Countries with a high level of financial literacy tend to have a better understanding of the benefits and risks associated with cryptocurrencies, leading to higher adoption rates. In contrast, countries with low financial literacy may be more hesitant to adopt cryptocurrencies due to a lack of understanding.

Cultural attitudes towards technology and innovation also play a role in cryptocurrency adoption. Countries that embrace new technologies and have a culture of innovation are more likely to adopt cryptocurrencies as they see the potential benefits it can bring. On the other hand, countries with a more conservative approach to technology may be slower to adopt cryptocurrencies.

Overall, the adoption of cryptocurrencies is a complex process that is influenced by a variety of factors. By understanding these factors and addressing them accordingly, countries can work towards increasing the adoption of cryptocurrencies and reaping the benefits they offer in terms of financial inclusion, security, and innovation.

Challenges and Opportunities for Cryptocurrency Adoption

There are various challenges and opportunities for the adoption of cryptocurrency around the world. One of the main challenges is the lack of regulatory clarity in many countries, which creates uncertainty for businesses and investors. This uncertainty can hinder the widespread adoption of cryptocurrencies as a legitimate form of payment.

On the other hand, there are also opportunities for cryptocurrency adoption, such as the potential for financial inclusion in underserved populations. Cryptocurrencies can provide access to financial services for people who are unbanked or underbanked, allowing them to participate in the global economy.

Another opportunity for cryptocurrency adoption is the potential for lower transaction fees compared to traditional banking systems. This can make cross-border payments more affordable and efficient, especially for small businesses and freelancers who rely on international transactions.

However, there are also challenges such as scalability issues and concerns about security and privacy. Scalability issues can lead to slow transaction times and high fees during times of high network activity, while security and privacy concerns can deter individuals and businesses from using cryptocurrencies.

In conclusion, while there are challenges to overcome, there are also significant opportunities for the adoption of cryptocurrency around the world. By addressing regulatory issues, improving scalability, and enhancing security measures, the widespread adoption of cryptocurrencies as a mainstream form of payment is within reach.

Regulatory Landscape Impacting Cryptocurrency Adoption

The regulatory landscape plays a crucial role in shaping the adoption of cryptocurrencies around the world. Governments and regulatory bodies have varying approaches to dealing with the emergence of digital currencies, which can impact the level of acceptance and integration of cryptocurrencies into mainstream financial systems.

In some countries, such as the United States and Japan, there are clear regulatory frameworks in place that provide guidelines for businesses and individuals looking to engage in cryptocurrency transactions. These regulations aim to protect consumers and prevent illicit activities such as money laundering and fraud. By providing a clear legal framework, these countries have been able to foster a more secure environment for cryptocurrency adoption.

On the other hand, some countries have taken a more cautious approach to regulating cryptocurrencies, either due to concerns about their potential impact on traditional financial systems or a lack of understanding of how digital currencies work. This uncertainty can create barriers to entry for businesses and investors, limiting the growth of the cryptocurrency market in those regions.

Overall, the regulatory landscape impacting cryptocurrency adoption is complex and constantly evolving. As governments and regulatory bodies continue to grapple with the challenges posed by digital currencies, it is essential for stakeholders in the cryptocurrency ecosystem to stay informed and engaged in the regulatory process to ensure a more seamless integration of cryptocurrencies into the global financial system.

Cryptocurrency Adoption Trends in Developing Economies

When it comes to cryptocurrency adoption trends in developing economies, there are several factors at play that influence the uptake of digital currencies in these regions. One of the main drivers of cryptocurrency adoption in developing economies is the lack of access to traditional banking services. Many people in these regions do not have access to banks or financial institutions, making it difficult for them to participate in the global economy. Cryptocurrencies offer a way for these individuals to store and transfer money without the need for a bank account.

Another factor that contributes to the adoption of cryptocurrencies in developing economies is the high levels of inflation and economic instability that are common in these regions. Traditional fiat currencies in many developing countries are prone to losing value rapidly due to inflation, government mismanagement, or political instability. Cryptocurrencies provide a more stable store of value for people in these regions, protecting their wealth from the fluctuations of their local currency.

Additionally, the rise of mobile technology has played a significant role in driving cryptocurrency adoption in developing economies. Many people in these regions have access to smartphones and the internet, allowing them to easily download a cryptocurrency wallet and start using digital currencies for transactions. This increased connectivity has made it easier for people in developing economies to participate in the global economy and access financial services through cryptocurrencies.

The Future of Cryptocurrency Adoption: Predictions and Projections

The future of cryptocurrency adoption is a topic of much speculation and debate among experts in the field. While some believe that cryptocurrencies will become mainstream in the near future, others are more cautious in their predictions. However, there are several trends and projections that can give us a glimpse into what the future may hold for cryptocurrency adoption around the world.

One of the key factors that will influence the adoption of cryptocurrencies is regulatory clarity. As governments around the world continue to develop regulations for cryptocurrencies, businesses and consumers will have a clearer understanding of how they can use and invest in these digital assets. This regulatory clarity will help to build trust in cryptocurrencies and encourage more widespread adoption.

Another important trend to watch is the rise of central bank digital currencies (CBDCs). Many countries are exploring the possibility of issuing their own digital currencies, which could potentially compete with existing cryptocurrencies like Bitcoin and Ethereum. The adoption of CBDCs could have a significant impact on the cryptocurrency market and how cryptocurrencies are used around the world.

Technological advancements will also play a crucial role in the adoption of cryptocurrencies. As blockchain technology continues to evolve and improve, cryptocurrencies will become more secure, scalable, and user-friendly. This will make it easier for businesses and consumers to use cryptocurrencies for everyday transactions, further driving adoption rates.

In conclusion, the future of cryptocurrency adoption is full of possibilities and uncertainties. While there are challenges and obstacles to overcome, the potential benefits of cryptocurrencies are too great to ignore. With the right regulatory environment, technological advancements, and consumer education, cryptocurrencies could revolutionize the way we think about money and finance in the years to come.